Small-cap stocks have recently taken the spotlight, leading the bull market with impressive gains. This surge, driven by hopes of interest rate cuts and a broader economic recovery, has positioned small-cap stocks as a key focus for investors. The Russell 2000 index, a benchmark for small-cap stocks, has risen significantly, outperforming larger indices like the S&P 500. This article delves into the factors behind this rally, its potential impact on the election, and the broader implications for the global economy.

The Recent Surge in Small-Cap Stocks

Performance Overview

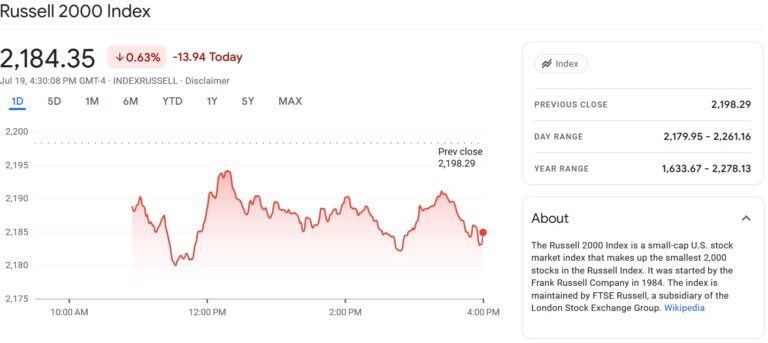

The Russell 2000 index rose 1% on Tuesday, reaching its highest level since January 2022. This marked the fifth consecutive day of gains over 1%, a rare occurrence since 1979. Over the past month, the index has gained more than 10%, nearly tripling the S&P 500’s performance. This remarkable rally highlights a shift in investor sentiment from megacap technology shares to smaller companies.

Driving Factors

- Interest Rate Cuts and Economic Recovery: The anticipation of interest rate cuts by the Federal Reserve has fueled optimism among investors. Lower borrowing costs are particularly beneficial for small-cap companies, which often have higher floating debt levels. The expectation is that reduced interest rates will enhance these companies’ ability to finance growth and expand operations.

- Market Rotation: Investors have been rotating out of megacap technology stocks and into small-cap stocks. This rotation is driven by the search for undervalued opportunities and higher growth potential. As megacap stocks have become expensive, small-caps present a more attractive valuation, especially in a recovering economy.

- Broadening Market Rally: The recent rally in small-cap stocks is part of a broader market trend. The S&P 600, another small-cap index, has shown continued earnings growth from a wide range of companies, indicating a healthy economic environment. This broader rally suggests that the economic recovery is not limited to a few large companies but is more widespread.

Analysis of the Current Rally

Historical Context and Future Prospects

Historically, small-cap stocks have offered higher returns than their larger counterparts, though with greater volatility. From 1926 to 2020, small-cap stocks had an average annual return of 12.2%, compared to 10.3% for large-cap stocks. Despite recent underperformance, historical data suggests that periods of lagging performance are often followed by significant outperformance. This cyclical nature supports the current rotation into small-cap stocks as a strategic move by investors.

Impact of Cooling Inflation

The latest inflation report from the Labor Department showed a decline in consumer prices, increasing expectations of a Federal Reserve rate cut. This cooling inflation has driven the recent surge in the Russell 2000, as lower borrowing costs are particularly advantageous for small-cap companies. The iShares Russell 2000 ETF (IWM) posted a 6.11% gain, breaking through significant resistance levels and signaling a positive trend shift.

Implications for Stakeholders

Investors

For investors, the current surge in small-cap stocks presents both opportunities and risks. The potential for higher returns and undervalued opportunities makes small-cap stocks an attractive investment. However, the inherent volatility and susceptibility to economic downturns necessitate a careful assessment of individual risk tolerance and investment goals.

Companies

For small-cap companies, increased investor interest and potential for lower borrowing costs could provide a significant boost. This environment may enable these companies to expand operations, invest in growth initiatives, and improve overall financial health. However, they must also navigate the challenges of increased market scrutiny and potential economic fluctuations.

Market Analysts and Policymakers

Market analysts and policymakers should closely monitor the evolving trends within the small-cap space. The rotation into small-cap stocks could signal broader economic shifts and provide insights into investor sentiment and market dynamics. Policymakers, particularly those at the Federal Reserve, should consider the implications of their monetary policies on different market segments, including small-cap stocks.

Broader Economic Implications

Global Markets and Investments

Global markets are closely watching the developments in U.S. small-cap stocks. The United States plays a central role in the global economy, and significant political or economic changes can have far-reaching effects. Emerging markets, in particular, may experience heightened volatility as they are more susceptible to changes in U.S. economic policies.

Trade Agreements and Partnerships

The potential shift in U.S. leadership could affect existing trade agreements and negotiations. Countries engaged in trade talks with the U.S. will be keenly interested in the election outcome. The stability of agreements like the USMCA and potential new trade deals could be influenced by the incoming administration’s stance on trade.

Climate Change and Environmental Policies

The Biden administration has taken significant steps towards addressing climate change. A change in administration could impact global climate efforts, either by accelerating initiatives under a Democratic leader or potentially slowing progress if a Republican administration takes a less aggressive stance on climate policies.

Conclusion

The recent surge in small-cap stocks is a multifaceted phenomenon driven by technical indicators, economic data, and broader market trends. The cooling inflation report and anticipated Federal Reserve rate cuts have created a favorable environment for small-cap stocks, while the shift in investor sentiment towards value stocks has further fueled this trend. For investors, companies, and market analysts, the current landscape presents both opportunities and challenges, necessitating a careful and strategic approach to navigating the evolving market dynamics. As we move forward, continued monitoring of economic data, policy decisions, and market trends will be essential in understanding and capitalizing on the potential of small-cap stocks.